Rescreening Employees Without Burnout: Balancing Risk, Cost

Learn how rescreening employees helps employers spot risks early, reducing the chance of insider threats, fraud, or compliance breaches, without burnout.

Read More

£36.00 Sign up fee

Pay as you go

Bulk Discount Available

Real-Time Solution

ATS & HRIS Integration

API Integration

Adverse Credit Check or Financial Background Screening is a type of a pre-employment screening check (employment vetting) that employers can carry out on prospective or current employees for sensitive positions and particularly those handling money and funds.

The Complygate’s Employment Credit Report is specifically designed to give businesses the information needed to help make smarter decisions quickly and easily when considering on potential candidates or review current employees.

Employers want to be sure that your financial position would not impact your performance at work and that you do not pose any risk when it comes to handling money or sensitive data. Law and finance firms are legally required to perform credit checks on prospective or current employees.

Yes, however, only you will be able to see it. It will appear as ‘COMPLYGATE’. Lenders would not be able to see if your report has been checked by your employer for the purpose of pre-employment screening (employee vetting), so your credit score would not be affected.

‘Adverse credit’ refers to any missed or non-payment on a individual’s credit report. The following types of adverse credit (red flags) will show up on an employment vetting credit check:

Complygate adverse credit check will not affect applicant’s credit score or ability to borrow.

Interpreting financial data is likely to require a greater degree of judgement than other preemployment checks. e.g. what is adverse credit history? This could include an unsustainable lifestyle or bad payment history.

Consideration should be given to the ability and planned efforts made to repay debts. Clear guidelines will help to ensure that your judgements are logical and defensible.

Complygate is one of the UK’s smartest pre-employment screening platforms. As part of a commitment to reducing risks and with our roots firmly in compliance, Complygate uses market knowledge and expertise to recommend an Employee vetting package that best suits the needs of your business.”

Get in touch today to find out how our additional services can benefit your people strategy.

Complygate Adverse credit check is also ideal for Tenant Background Check (Credit check for landlords).

Our Tenant check service is simple to use. There is no minimum commitment or set up fee for the credit check for renters and is available from as little as £4 per check.

Adverse Credit Check or Financial Background Screening is a type of pre-employment screening check (employment vetting) that employers can carry out on employees for sensitive positions and particularly those handling money, client money and funds. Employment Credit Report is specifically designed to give businesses the information needed to help make smarter decisions quickly and easily when considering potential candidates or reviewing current employees.

What will my employer be able to see after performing an adverse credit check?

‘Adverse credit’ refers to any missed or non-payment on an individual’s credit report. The following types of adverse credit (red flags) will show up on an employment vetting credit check:

Complygate adverse credit check will not affect the applicant’s credit score or ability to borrow.

A credit check or credit search is when a financial institution or a lender looks at information from your credit report to understand your financial behaviour and affordability. Following companies that may do a credit search on you with a legitimate reason or your consent:

Employers want to be sure that your financial position would not impact your performance at work and that you do not pose any risk when it comes to handling money or sensitive data. Law and finance firms are legally required to perform credit checks on prospective or current employees.

Financial Probity checks have a very limited and specific legal meaning. It is different to a credit check. A financial probity check involves searches of publicly available data. These show two things.

This is all information that is open to the public and held on central registers. As the information is public, an employer doesn’t need your consent to run these checks. Many will also check that you are listed on the electoral register at the address you’ve given.

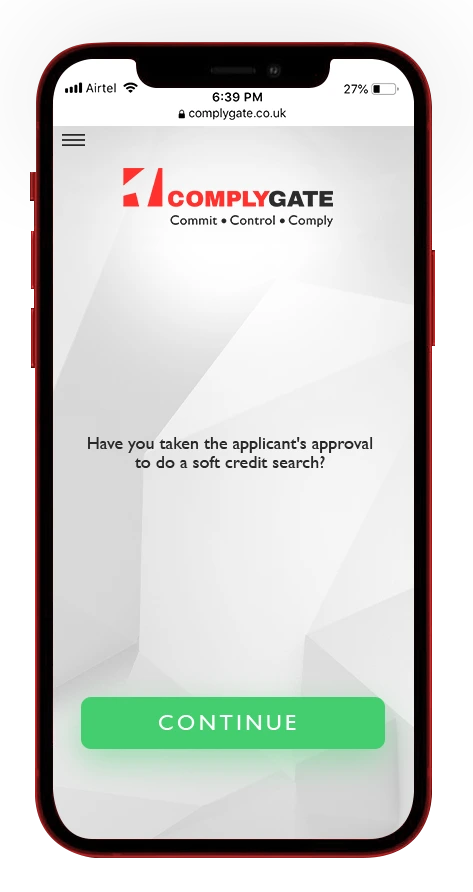

A soft credit search, also known as a soft credit check, is not visible to third parties or lenders on your credit report. Credit checks for employment screening or tenant vetting is a few examples of soft credit check. Soft credit checks do not leave a visible footprint on your credit file and do not affect your affordability to avail financial products or credit in future.

In a hard credit search, a financial institution makes a search of your credit report, which is recorded on your report, so any company searching it will be able to see that you have applied for credit.

Credit history checks leave traces on your credit report, lenders can use them to see how you qualify for a wide range of credit without applying. Unlike, adverse credit check which is a soft credit search that is not visible to lenders or other third parties.

Check our blog for latest industry news and update about new releases.

Complygate is the best HR software for SMEs.

Learn how rescreening employees helps employers spot risks early, reducing the chance of insider threats, fraud, or compliance breaches, without burnout.

Read MoreProtect your business with smart background checks. Learn why pre employment screening is essential against fraud, insider threats & false applications.

Read MoreDiscover how BS7858 screening helps prevent insider threats, fraud, and data breaches by ensuring you're hiring trustworthy, vetted employees.

Read More